Home insurance is essential for protecting your property and belongings from unexpected events like fires, theft, or natural disasters. However, the cost of premiums can sometimes feel overwhelming. The good news is that there are smart ways to reduce your home insurance premiums without sacrificing coverage. By making informed decisions and taking simple steps, you can save money while keeping your home protected.

Shop Around for the Best Rate

Not all insurance companies charge the same premiums. It pays to compare offers from multiple insurers to see who provides the best deal. Online tools and insurance brokers can make it easier to find options that suit your budget and coverage needs. Even a small difference in rates can save you hundreds each year.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible usually lowers your premium because you’re taking on more responsibility for small claims. Just make sure you have enough savings set aside to cover the deductible in case you need to file a claim.

Bundle Your Policies

Many insurance companies offer discounts if you bundle your home insurance with other policies, like auto or life insurance. Bundling simplifies your payments and can lead to significant savings. It’s worth asking your insurer if they provide such discounts.

Improve Home Security

A safer home often means lower premiums. Installing security systems, smoke detectors, burglar alarms, or smart locks can reduce your risk of damage or theft. Some insurance companies even provide discounts if you install certified safety devices.

Maintain a Good Credit Score

Believe it or not, your credit score can affect your insurance premiums. Insurers often view people with higher credit scores as more reliable, which may lead to lower rates. Paying bills on time, reducing debt, and managing credit responsibly can improve your score and cut your insurance costs.

Reduce Risks Around Your Home

Certain features, like old wiring, damaged roofs, or swimming pools, may raise your insurance premiums because they increase risk. Making repairs, upgrading systems, or reducing hazards can lower the chances of claims and help you qualify for better rates.

Review Your Coverage Regularly

Over time, you may find that you’re paying for coverage you don’t need. For example, you might be insuring expensive jewelry or electronics that you no longer own. Reviewing your policy each year and adjusting it to fit your current situation ensures you’re not paying for unnecessary extras.

Ask About Discounts

Many insurers provide discounts that policyholders often overlook. These can include senior discounts, loyalty rewards, or savings for going years without filing a claim. Asking your insurer about all available discounts could reveal opportunities to lower your premium.

Lowering your home insurance premium is about being proactive. By shopping around, improving your home’s safety, bundling policies, and maintaining good financial habits, you can reduce costs without giving up essential protection. A little effort now can lead to big savings in the long run.

Related Articles

Steps to Refinance Your Mortgage Successfully

Refinancing your mortgage can be a smart move to lower your monthly...

Top Life Insurance Providers

Life insurance is one of the most important financial tools to protect...

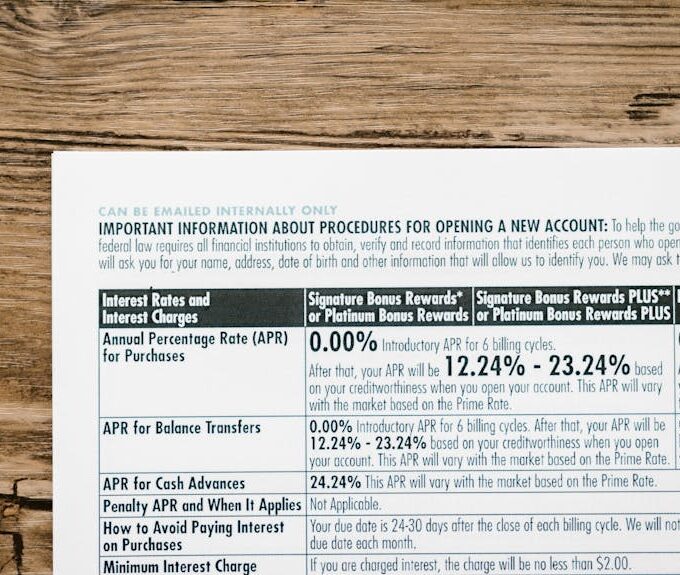

Balance Transfers: What You Need to Know

Credit card debt can be overwhelming, especially with high interest rates that...

Hidden Costs in Home Loans You Should Know

Buying a home is one of the biggest financial decisions most people...