Getting approved for a loan—whether it’s for a car, home, or personal expenses—can sometimes feel challenging. Lenders look at your financial history, income, and overall risk before deciding if they’ll lend you money. The good news is there are practical steps you can take to improve your chances of approval. With the right preparation, you can increase your likelihood of success and possibly get better loan terms.

Maintain a Good Credit Score

Your credit score is one of the first things lenders check. A higher score tells them you’re responsible with money, which makes you less risky to lend to. To improve your score, pay bills on time, reduce debt, and avoid applying for too many new credit accounts. Even small improvements can make a big difference in your approval chances.

Show Stable Income

Lenders want to know that you can afford the loan payments. A steady job and consistent income make you look more reliable. If you’re self-employed, providing tax returns, bank statements, or contracts can help prove your income stability. Having a solid employment history also boosts confidence in your ability to repay.

Reduce Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is the percentage of your income that goes toward paying existing debts. A lower DTI shows lenders that you have enough income left to handle new loan payments. Paying down credit cards, student loans, or other debts before applying can improve your DTI and increase your chances of approval.

Save for a Down Payment

For loans like mortgages or auto financing, a down payment can greatly strengthen your application. It lowers the loan amount you need and shows lenders you’re financially committed. A larger down payment may even help you qualify for lower interest rates.

Get Pre-Approved

Pre-approval is like a practice run with lenders. They check your financial information and let you know how much you might qualify for. Getting pre-approved not only helps you understand your budget but also shows sellers or dealers that you’re a serious buyer.

Avoid Major Financial Changes Before Applying

Big financial changes, like switching jobs or taking on new debt, can hurt your chances of loan approval. Lenders prefer to see stability. Try to avoid opening new credit cards or making large purchases right before applying for a loan.

Compare Lenders and Loan Options

Not all lenders are the same. Some may be more flexible or offer better terms than others. Take time to compare banks, credit unions, and online lenders. Even if one denies you, another might approve your application under different terms.

Consider a Co-Signer

If you’re struggling to get approved on your own, a co-signer with a strong financial background can help. This person agrees to share responsibility for the loan, giving lenders more confidence. However, it’s a big commitment for both parties, so make sure everyone is comfortable with the arrangement.

Improving your chances of loan approval isn’t just about luck—it’s about preparation. By maintaining a good credit score, showing stable income, reducing debt, and exploring all your options, you’ll be more likely to succeed. Taking time to prepare before applying can lead to faster approval, better loan terms, and greater peace of mind.

Related Articles

How to Lower Your Home Insurance Premium

Home insurance is essential for protecting your property and belongings from unexpected...

Steps to Refinance Your Mortgage Successfully

Refinancing your mortgage can be a smart move to lower your monthly...

Top Life Insurance Providers

Life insurance is one of the most important financial tools to protect...

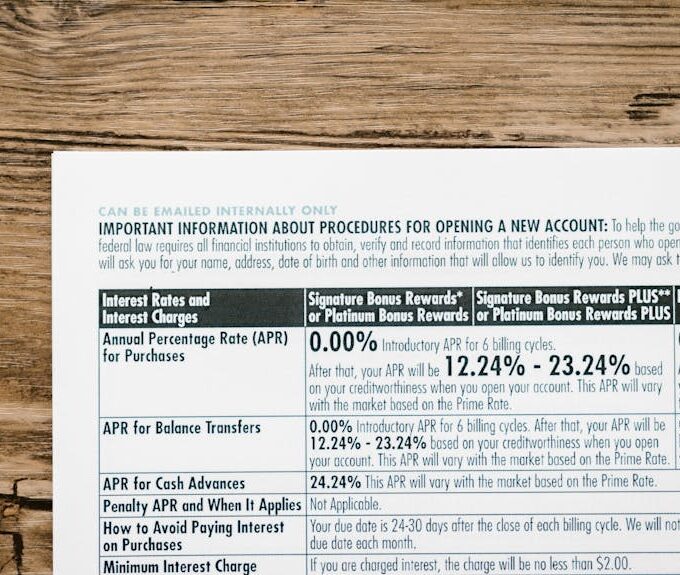

Balance Transfers: What You Need to Know

Credit card debt can be overwhelming, especially with high interest rates that...