Buying a home is one of the biggest financial decisions most people will ever make. While many buyers focus on the purchase price of the house and the monthly mortgage payment, there are several hidden costs tied to home loans that can surprise you. Understanding these costs before you sign the paperwork can save you money and stress in the long run.

Application and Processing Fees

Before your loan is even approved, many lenders charge an application fee. This covers the cost of checking your credit, reviewing your paperwork, and handling administrative tasks. Sometimes, these fees are non-refundable even if your loan is denied. On top of this, you may also face processing charges that lenders add for handling documents and verifying your information.

Origination Fees

An origination fee is what lenders charge for creating and approving your loan. This is usually a percentage of the loan amount, often between 0.5% and 1%. While it may not sound like much, on a large mortgage, this can add up to thousands of dollars. Some lenders allow negotiation on origination fees, so it’s worth asking if they can be reduced or waived.

Appraisal and Inspection Costs

Before approving your loan, the lender wants to ensure the property is worth the amount you’re borrowing. That’s where appraisal fees come in. A professional appraiser evaluates the property’s value, and you’re responsible for the cost. In addition, you may need to pay for inspections, such as pest, structural, or environmental checks, to satisfy lender requirements.

Title Search and Title Insurance

To make sure the home has no legal claims or unpaid taxes tied to it, lenders require a title search. This process checks property records and ensures there are no disputes. Title insurance, which protects both you and the lender in case of hidden issues, is another expense. While it’s a one-time payment, it can be quite costly.

Private Mortgage Insurance (PMI)

If your down payment is less than 20% of the home’s price, you’ll likely have to pay private mortgage insurance. PMI protects the lender in case you default on the loan. Although it doesn’t benefit the borrower directly, it can add hundreds of dollars to your monthly payment. The good news is that PMI can usually be canceled once you’ve built enough equity in the home.

Closing Costs

Closing costs are a bundle of fees due when the loan is finalized. They include legal fees, recording charges, escrow deposits, and taxes. On average, closing costs range from 2% to 5% of the loan amount. For many buyers, this is one of the biggest surprises, as it significantly increases the upfront money needed.

Prepayment Penalties

Some home loans come with prepayment penalties if you pay off the loan early. Lenders add this clause to make sure they don’t lose interest income. If you plan to refinance or pay off your loan faster, check whether your mortgage includes such a penalty. Avoiding this cost upfront can save you thousands later.

Homeowners Insurance and Taxes

While not directly part of the loan, lenders require proof of homeowners insurance before approving a mortgage. This protects both you and the lender if something happens to the property. Property taxes are also collected and sometimes included in your monthly payment. These costs can vary widely depending on your location.

Home loans come with more than just principal and interest. Fees like origination, appraisal, PMI, and closing costs can significantly affect your budget. By being aware of these hidden expenses and asking the right questions before signing, you can plan better and avoid unpleasant surprises.

Related Articles

How to Lower Your Home Insurance Premium

Home insurance is essential for protecting your property and belongings from unexpected...

Steps to Refinance Your Mortgage Successfully

Refinancing your mortgage can be a smart move to lower your monthly...

Top Life Insurance Providers

Life insurance is one of the most important financial tools to protect...

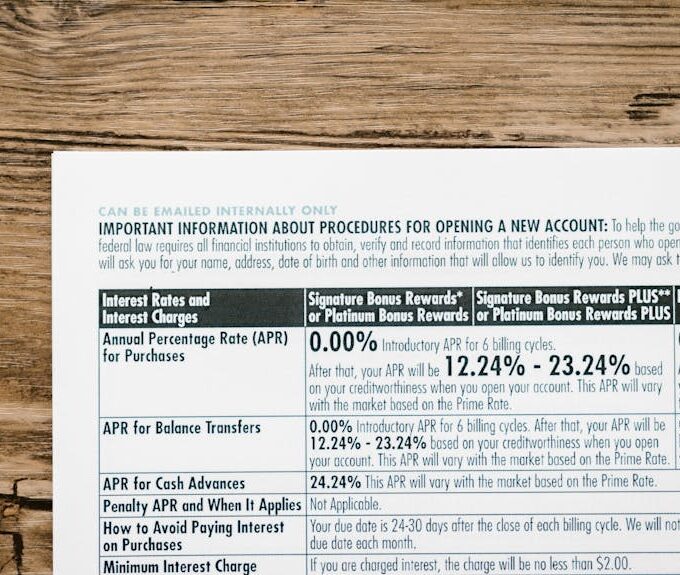

Balance Transfers: What You Need to Know

Credit card debt can be overwhelming, especially with high interest rates that...