Credit card debt can be overwhelming, especially with high interest rates that make it hard to pay down the balance. One tool that many people use to manage debt is a balance transfer. This option allows you to move debt from one credit card to another, usually with a lower interest rate. While it can be a smart financial move, it’s important to understand the details, benefits, and risks before making the switch.

What Is a Balance Transfer?

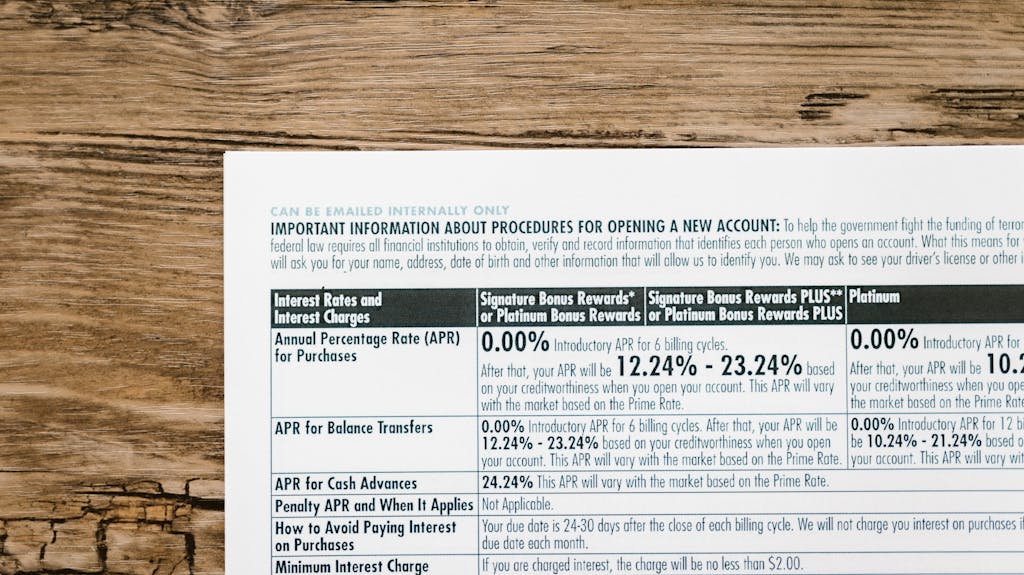

A balance transfer is when you take the existing debt on one credit card and move it to another card with a lower or 0% introductory interest rate. The main goal is to save money on interest so you can pay off the debt faster. Many credit card companies offer promotional deals to attract new customers.

Balance Transfer Fees

One of the most overlooked costs is the balance transfer fee. Most cards charge between 3% and 5% of the amount you’re transferring. For example, if you move $5,000, the fee could be $150 to $250. While the savings on interest can outweigh this fee, it’s important to calculate if the move is truly worth it.

Introductory Period Limitations

The 0% or low-interest rate on balance transfers doesn’t last forever. Most promotional periods range from 12 to 21 months. After that, the regular interest rate applies, which may be as high—or even higher—than your original card. Make sure you have a realistic plan to pay off your balance during the introductory period.

Impact on Credit Score

Applying for a new credit card and transferring balances can temporarily affect your credit score. A hard inquiry lowers your score slightly, and a higher credit utilization ratio could also impact it. However, if you use the transfer responsibly and reduce your debt, your credit score can improve in the long run.

Minimum Payments Still Apply

Even with a balance transfer, you still have to make at least the minimum payment every month. Missing payments could cancel the promotional rate and trigger penalty fees. To make the most of a balance transfer, it’s important to stay disciplined and consistent with payments.

Avoid New Purchases on the Transfer Card

Many balance transfer cards apply the promotional interest rate only to the transferred balance, not new purchases. If you start spending on the same card, those new charges might rack up interest right away. To avoid confusion, it’s best to use the card only for paying down the transferred balance.

Alternatives to Consider

While balance transfers can be helpful, they’re not always the right solution. Personal loans, debt management programs, or negotiating lower interest rates with your current lender may be better options for some people. Compare all possibilities before making a decision.

Who Should Use Balance Transfers?

Balance transfers are most effective for people with good credit who can qualify for promotional offers and who are committed to paying off the debt during the low-interest period. If you continue to add new debt or only make minimum payments, the benefits can quickly disappear.

Balance transfers can be a powerful tool to reduce credit card debt if used wisely. Understanding the fees, time limits, and potential impact on your credit score is essential. With careful planning and disciplined payments, a balance transfer can help you save money and get closer to becoming debt-free.

Related Articles

How to Lower Your Home Insurance Premium

Home insurance is essential for protecting your property and belongings from unexpected...

Steps to Refinance Your Mortgage Successfully

Refinancing your mortgage can be a smart move to lower your monthly...

Top Life Insurance Providers

Life insurance is one of the most important financial tools to protect...

Hidden Costs in Home Loans You Should Know

Buying a home is one of the biggest financial decisions most people...